Last week I was in Dunkin’ Donuts and noticed something odd—although the oddness did not strike me immediately. The woman who was serving me could have been my grandmother. Ditto that when I was at Home Depot in the lighting aisle yesterday. And ditto it again in Walmart this morning.

I would never dream of seeing that as a kid. Ever.

The episodes came to mind after reading a piece in the Washington Post this weekend:

The Devers are better off than many Americans. One in 5 have no savings, and millions retire with nothing in the bank. Nearly 30 percent of households headed by someone 55 or older have neither a pension nor any retirement savings, according to a 2015 report from the U.S. Government Accountability Office.

Not too long ago, I was discussing with my dad income tiers and the brackets defining upper and middle class. I have seen numerous articles written recently describing how we all characterize ourselves as middle class. In fact, outside of Warren Buffet, Bill Gates, and a few of their poker buddies, the remaining 99.9% of the country would self-define themselves as inhabiting the middle of the class divide. Nice distribution curve if you can find it; we all want to call ourselves average–at least as wallet size goes.

I contrast the WaPo article and the conversation with my dad with the detachment we as providers have given the homes we live in, the cars we drive, the meals we eat, the circles we run in, and the entertainment we crave.

It’s all about context, however, and I would venture to guess if I asked our professional community to calculate the average wealth of the senior demographic today, we all would be off by a factor of two to three times plus. In fact, I would go further and ascribe all the talk related to flipping Medicare to a more beneficiary at-risk system, being bullish on stocks associated with devices, communities, services, and residences with the aging and retired boomers, and gutting Medicaid with the disconnect I alluded to two paragraphs ago.

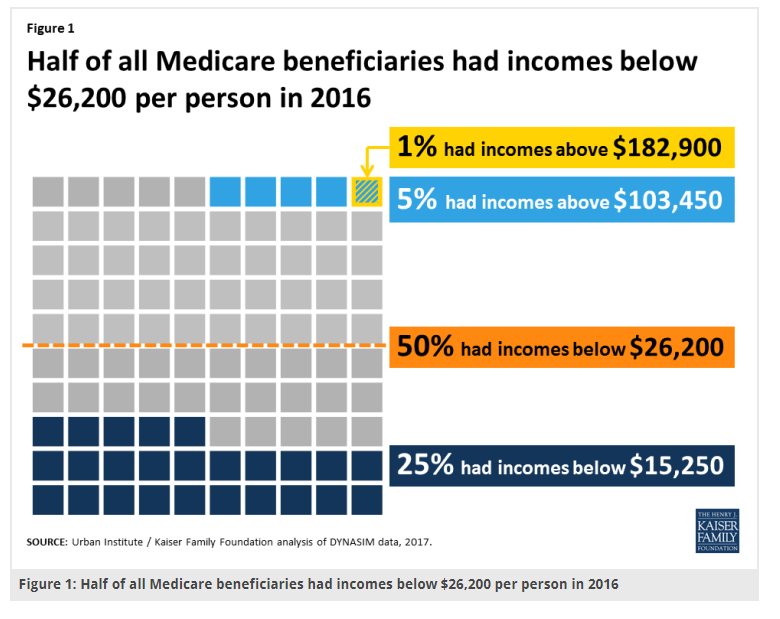

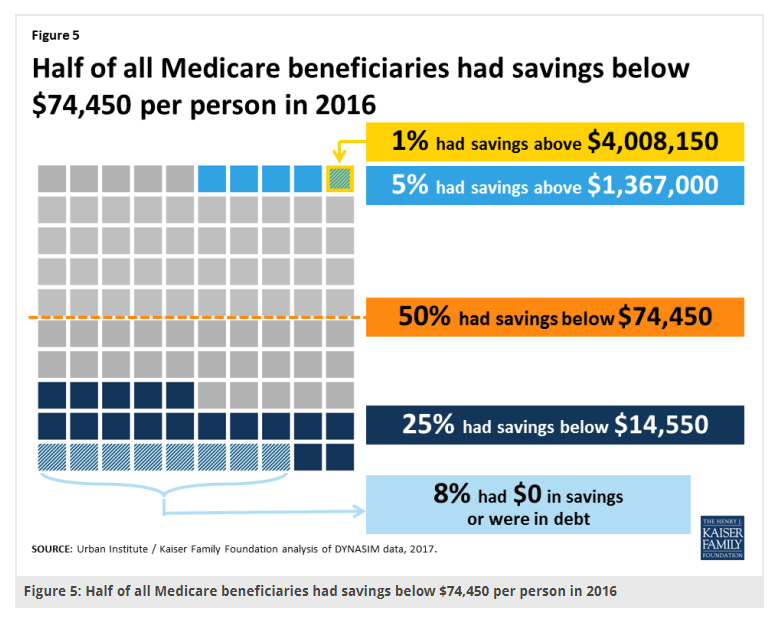

If you read the article from The Post, you will grasp how desperate the situation has become. But if you need additional convincing, have a look at these two sobering figures from KFF:

No income to speak of. No savings. HALF!!! Let that sink in. If your fixed income flow exceeds $50K/year and you have a few hundred G’s in your IRA, you might as well roll in the Brink’s truck.

In conversations about health policy, folks sometimes ask me what concerns me the most or where do I see the biggest crisis ahead? If I answered with problems such as chronic disease, distressed primary care, a busted reimbursement system, or dysfunctional markets, etc., etc., no one would flinch or shudder. So much of it needs fixing. But along with mental health services, long-term care and service supports worries me the most and tops my list. Seventy percent of folks will require it past 65 years old in some form or another. The. Expense. Is. Massive.

Given families and friends provide several hundred billion in uncompensated care already, where in the hell is the money going to come from to finance skilled and custodial needs over the next twenty-five years? We cannot even repair our roads and bridges.

From the meager asset accounts above, it is not coming from current retirees. And seeing them is really us, and we are the taxpayers, we are all in this boat together. Long-term care buoyed by donut packaging, lighting tips, and creative ways to talk up the deal of the day hardly seems befitting of the greatest generation and the wealthiest country in the world, yet here we are.

Read the article. Once you do, you will cast aside any thoughts of resurrecting balance billing and high-deductible health plans for seniors as a means to solve the ills of our health system, no less how to care for them in their golden years.

Leave A Comment