Modern Healthcare has a nice piece out today examining the state of hospital growth and consolidation:

Many hospitals across the country are reaching a crossroads. The median age of U.S. hospital buildings is rising, and new construction has dropped sharply, with capital going toward ambulatory-care facilities, physician hiring, information technology and telehealth. Mobile-health apps will become more prevalent over the next few years as hospitals, patients and insurers look for new ways to improve care and reduce costs.

The piece emphasizes the travails both rural hospitals and AMCs will face as they sail into reform headwinds.

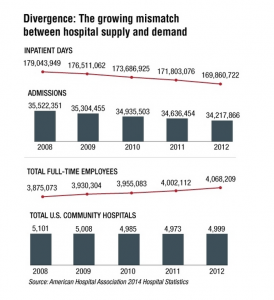

Industry trends also seem to offer a cautionary tale to all hospitals, regardless of size, region, and demographic served:

I wish to highlight two points however. First, even for folks who follow the vicissitudes of the healthcare economy, parsing the one day up, the next day down reports we see published from government agencies and think tanks can be a challenge. Has the country gotten its footing back and will spending begin to take off? No one knows.

Some feel the structural changes brought about by the recession, the ACA, and increased awareness of cost control in the early aughts has decreased the rate of health care cost growth permanently. Others attribute the decreases mostly to cyclical trends.

Selected hospitals, by virtue of their locales and populations served, will take a hit, morph, or even disappear. But while spending may not match levels seen a decade or so ago, current boosts in consumer confidence could open the spigots and fill some of the empty beds.

Also, take note of the movements in the figure above. The absolute changes are small and do not augur outright doom. Again, the rumors of the sector’s demise may be greatly exaggerated.

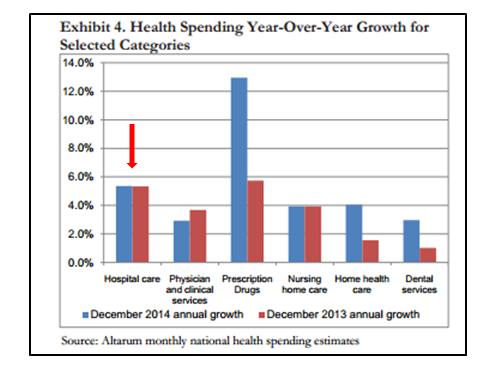

See the most recent report from Altarum (a widely circulated and respected monthly brief):

This month’s spending brief [February] provides an initial look at spending for the entire 2014 calendar year and suggests that national health spending grew by 5.0% from its 2013 level—a rate higher than the historically low 2013 growth rate of 3.6%. This might suggest a start to the long anticipated acceleration in health spending associated with increased insurance coverage and an improving economy […]

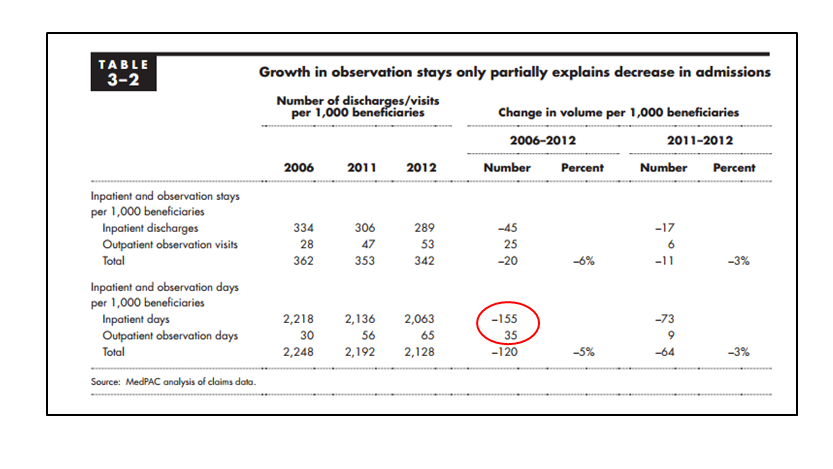

Second, the piece also attributes “the fuel” propelling the inpatient to outpatient shift to the two-midnight rule and the increased use of observation status. Because the storyline fits the script, it’s easy to attribute the change to the despised rule. Not so.

If you have a look at below, you will see the prominent relative increase in observation use. However, in absolute terms, and especially in comparison to inpatient bed use, obs utilization does not have great impact. The two-midnight rule is one of many factors directing inpatient trends, just not a biggie.

So many concurrent changes makes prognostication difficult. Yes we will scale back, and yes we will close some beds. But we will also repurpose our facilities, and see another day (whether that’s good for the country or us is another subject). For profit hospitals certainly dont seem to be hurting.

Its the hospitals at the tail end of the curve however, squeaking by at the margins I see as most vulnerable in the 5-10 year time horizon. Those are the institutions on which the article speaks loudest and the ones most subject to big haircuts–or if the blade should slip, major trauma.

Leave A Comment